Make a gift of stock

A donation of publicly traded securities is one of the easiest and most effective ways you can support the Alzheimer Society of Canada. And you can avoid the capital gains tax that you would normally have to pay if you sold the securities and then donated the proceeds.

The Alzheimer Society will issue you a charitable tax receipt for the fair market value of the security on the date of transfer into our brokerage account. You can donate securities now or as part of your estate planning.

How does it work?

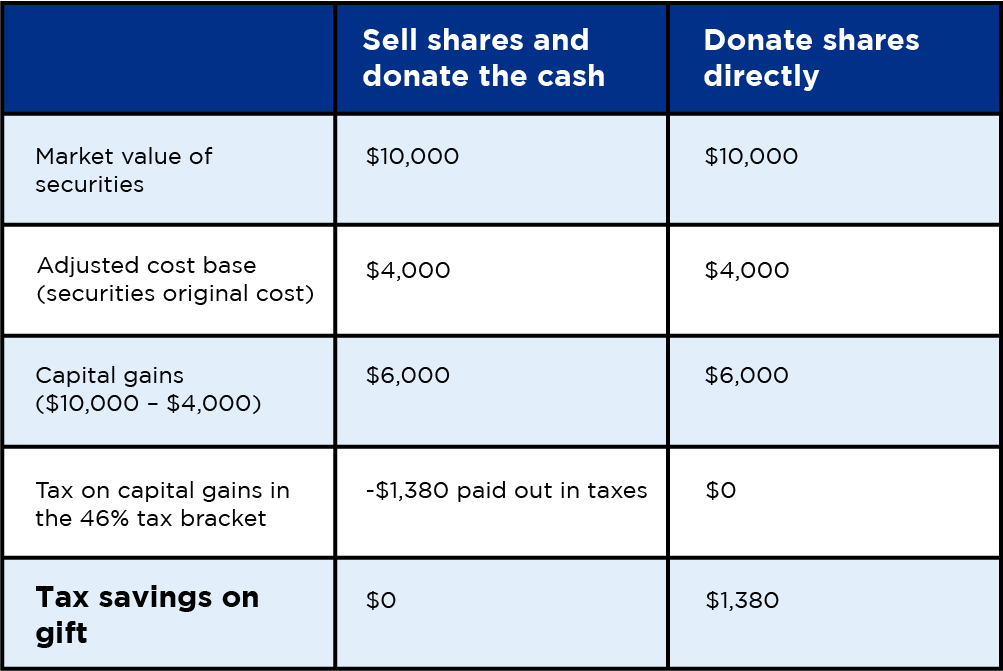

Here’s an example of the benefits of donating stocks:

Janet is a donor in the 46% tax bracket (assuming a provincial tax rate of 17%). She has already donated $200 this year to the Alzheimer Society of Canada*.

The below chart shows the difference in tax savings for Janet if she donates stock worth $10,000, which is the current value of the shares with an adjusted cost base of $4,000, versus selling the shares and donating the cash.

*The first $200 of charitable donations attracts tax credits at a lower rate.

More information and resources

To explore the benefits of this type of giving, please contact Dana Lecours, Office of Planned Giving, by email at [email protected] or by phone at 416-847-2951 (toll-free: 1-800-616-8816 ext. 2951).

You can also complete our fillable donation form of Publicly Traded Securities.